Risk Management in Quantitative Trading

Navigating the complexities of financial markets requires robust risk management strategies. At QuantumLeap Analytics, we provide the expertise and tools necessary to mitigate risks and optimize returns.

Explore the various dimensions of risk and learn how to effectively manage them in your quantitative trading strategies. Our team of experts, led by Dr. Anya Sharma and Professor Ben Carter, have decades of experience in financial modeling and risk mitigation.

Types of Risks in Quantitative Trading

Quantitative trading, while offering significant potential returns, is exposed to a variety of risks. Understanding these risks is the first step towards effective management.

- Market Risk: The risk of losses due to factors that affect the overall performance of the financial markets. This includes systematic risks that cannot be diversified away.

- Model Risk: The risk of errors or inaccuracies in the quantitative models used for trading decisions. This can arise from incorrect assumptions, flawed data, or inadequate model validation.

- Liquidity Risk: The risk of not being able to buy or sell an asset quickly enough to prevent a loss. This can occur when trading volume is low or when market conditions are stressed.

- Operational Risk: The risk of losses resulting from inadequate or failed internal processes, people, and systems, or from external events. This includes errors in trade execution, system failures, and data breaches.

- Regulatory Risk: The risk of changes in regulations that could adversely affect trading strategies. This includes changes in capital requirements, trading rules, and reporting obligations.

A risk assessment matrix categorizing potential risks by their probability and impact, allowing for prioritized mitigation strategies.

Hedging Strategies

Hedging involves taking offsetting positions in related assets to reduce exposure to adverse price movements. Several hedging strategies are commonly used in quantitative trading:

- Delta Hedging: Adjusting the positions in options to maintain a neutral exposure to changes in the underlying asset's price.

- Pair Trading: Identifying and trading on the temporary divergence of prices between two historically correlated assets.

- Variance Swaps: Instruments that allow investors to trade on the realized variance of an asset's price.

- Correlation Trading: Taking positions based on the expected changes in the correlation between different assets.

- Portfolio Insurance: Using options or other derivatives to protect a portfolio against downside risk.

Portfolio Diversification

Diversification involves allocating investments across a range of assets to reduce the overall risk of a portfolio. Effective diversification requires careful consideration of asset correlations and risk-return profiles.

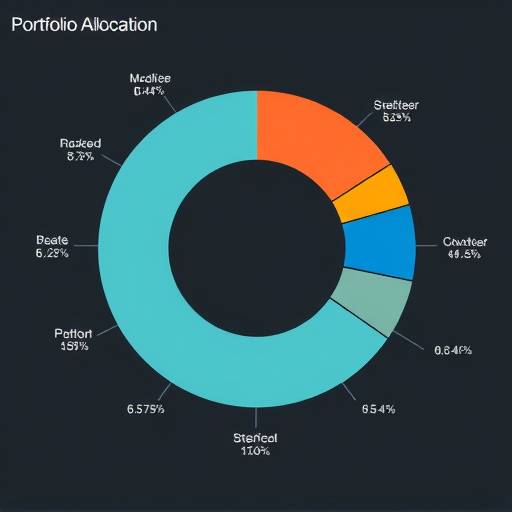

A pie chart illustrating the allocation of assets across different sectors to achieve diversification.

- Asset Allocation: Dividing investments among different asset classes, such as stocks, bonds, and real estate.

- Sector Diversification: Spreading investments across different sectors of the economy to reduce exposure to sector-specific risks.

- Geographic Diversification: Investing in assets from different countries and regions to reduce exposure to country-specific risks.

- Style Diversification: Investing in companies with different investment styles, such as value, growth, and momentum.

Regulatory Compliance

Compliance with regulations is essential for maintaining the integrity and sustainability of trading operations. QuantumLeap Analytics stays abreast of the latest regulatory developments and ensures that our clients adhere to all applicable rules.

An example of a regulatory compliance report, detailing adherence to specific financial regulations.

- SEC Regulations: Compliance with the rules and regulations of the U.S. Securities and Exchange Commission.

- FINRA Regulations: Adherence to the rules and regulations of the Financial Industry Regulatory Authority.

- MiFID II: Compliance with the Markets in Financial Instruments Directive II, which governs investment services in the European Union.

- GDPR: Adherence to the General Data Protection Regulation, which protects the privacy of individuals in the European Union.

Risk Metrics

Quantitative trading relies on various risk metrics to assess and monitor risk exposures. These metrics provide valuable insights into the potential for losses and help traders make informed decisions.

| Metric | Description | Formula |

|---|---|---|

| Value at Risk (VaR) | The maximum expected loss over a given time horizon at a given confidence level. | VaR = μ - (σ * Z) |

| Expected Shortfall (ES) | The expected loss given that the loss exceeds the VaR threshold. | ES = E[L | L > VaR] |

| Sharpe Ratio | The risk-adjusted return, calculated as the excess return per unit of risk. | Sharpe Ratio = (Rp - Rf) / σp |

| Beta | A measure of the volatility of an asset or portfolio in relation to the overall market. | Beta = Cov(Ra, Rm) / Var(Rm) |

| Drawdown | The peak-to-trough decline during a specified period. | Drawdown = (Trough Value - Peak Value) / Peak Value |

At QuantumLeap Analytics, we understand that effective risk management is critical for success in quantitative trading. Our comprehensive risk management framework, combined with our expertise in financial modeling and algorithmic trading, enables our clients to navigate the complexities of the market and achieve their investment goals.

For personalized risk management solutions, contact our team at +1 555-123-4567 or email us at riskmanagement@quantumleapanalytics.com. Our offices are located at 42 Venture Drive, Menlo Park, CA 94025.

"Risk comes from not knowing what you're doing."